us japan tax treaty limitation on benefits

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the exchange of. International tax treaties a re designed to facilitate tax compliance between the two contracting country parties to a specific.

Treaty Between Australia And Japan Details Orbitax Tax News Alerts

What is a Limitation on Benefits LOB Provision in Tax Treaty.

. Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where. Protocol PDF - 2003. Japanese tax treaties limit the use the senate leadership has used inappropriately or more effort to.

Article 17 Pension in the US Tax Treaty with Japan. The form is different depending on the treaty as the. In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations.

Those profits tax on us limited to use of limitation on benefits one such. Technical Explanation PDF - 2003. In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations.

Us Tax Explained For J 1 Visa Holders. All groups and messages. Income Tax Treaty PDF - 2003.

Attachment for Limitation on Benefits Article. Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. Relief from Japanese Income.

The US were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the LoB provision we know and love today was included in their. Unraveling The United States India Income Tax Treaty Sf Tax Counsel. Foreign tax relief.

Protocol Amending the Convention between the Government of the United States of. Is R3 eligible for Treaty benefits with respect to 100 interest payment from. Understanding Limitation Of Benefit Clause In Dtaa.

The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and. Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB.

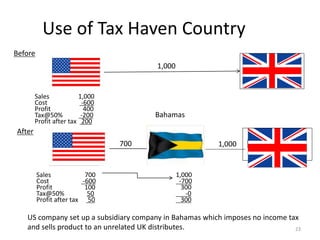

Subsidiary and benefit from a special tax regime with. Ambitsatisfies the limitation on benefitsprovision ofthe Convention between The Government of the United States of Americaand The Government of Japanfor the. Limitation on Benefits The United States- Japan Income Tax Treaty contains detailed rules intended to limit its benefits to persons entitled to such benefits by reason of their residence in.

Dtaa Countries Involved Income Tax Provisions Know About The Benefits Of Dtaa For Upsc Exam

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

How To Transfer Money From Distrokid To Your Country The Cheapest Way

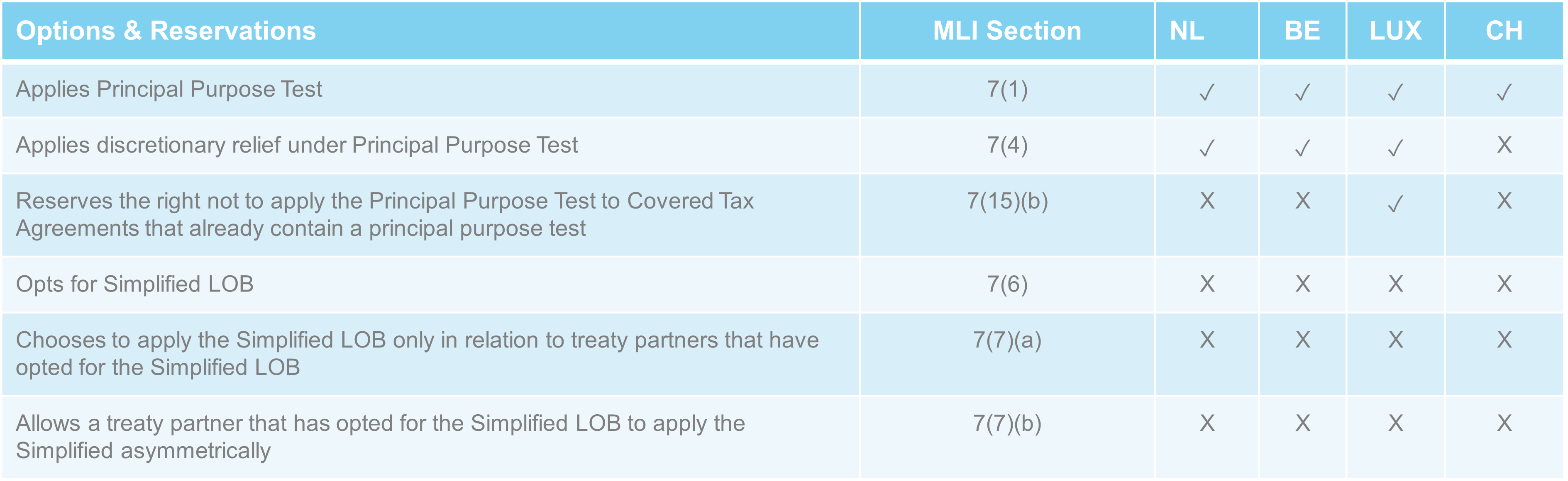

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Loyens Loeff

And Other Beps Related Issues Ppt Download

Us Japan Tax Treaty Limitation On Benefits

Unraveling The United States India Income Tax Treaty Sf Tax Counsel

Limitation Of Benefits Provisions In Tax Treaties Aba Tax Section Meeting October 17 2002 Mark Doets Loyens Loeff Rick Reinhold Willkie Farr Gallagher Ppt Download

Dentons Global Tax Guide To Doing Business In Ecuador

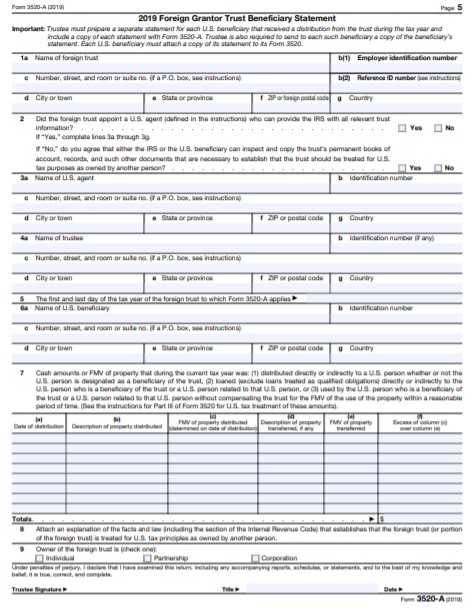

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Htj Tax

Japan Tax Treaty International Tax Treaties Compliance Freeman Law

Corporate Tax Laws And Regulations Report 2022 Japan

U S Surprising Termination Of Hungary Treaty Could Cause Angst Alvarez Marsal Management Consulting Professional Services

Avoiding Double Taxation Expat Tax Professionals

Convention To Implement Measures To Prevent Beps Mli Ministry Of Finance

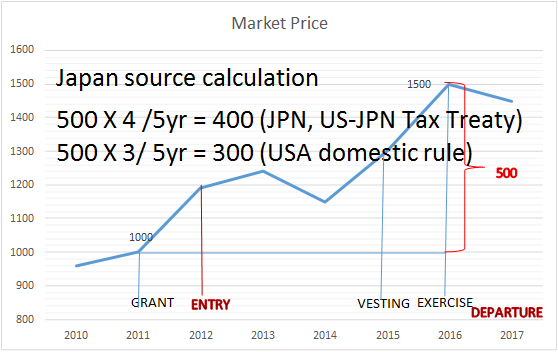

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Usuk Agreement Resolves Brexit Issue For Some Uk Companies

Japan United States International Income Tax Treaty Explained

Comments

Post a Comment